What happened to Drones? Where is the drone market heading?

Drones will be everywhere soon:

- Drone service companies will need them to deliver products and inspect roads, railways, and even underwater.

- Flying taxis will transport people over dense traffic-ridden cities.

- Hobbyists will use them to capture unique, never-seen videography.

- Rescue workers will apply them to save lives by flying medicine and blood into inaccessible locations.

- Lifeguards will employ them to rescue swimmers.

- Farmers will use drone services to optimize their farm yields through better imagery and precise spraying.

- Creepy neighbors will use them to invade your privacy.

- Malicious pilots will fly drones into aircraft, causing a major commercial aviation disaster.

- Governments will use them to keep track of you and even target assassinations.

- Terrorists will use them in swarms to deliver lethal strikes to infrastructure and much more sophisticated militaries.

Yes, drones are an appealing technology with great potential for good and evil.

If you follow the latest news on drones, you might conclude this is an exceedingly large and hyper-growth industry.

Maybe you are an entrepreneur who bought into the hyper-growth story.

Perhaps you invested in setting up a drone service business.

After spending so much money, you struggle to find profitable drone service opportunities.

Or you’re an end-user who bought into the potential and is looking to build a fleet of drones.

You are trying to assemble all the ecosystems required for a functional unmanned aerial system (UAS).

Perhaps you discovered that several of the firms you are seeking to do business with are small startups.

Now, you discover that many startups have more of a dream than actual capabilities.

The Drone Services Market, in reality, differs from the hype.

What is going on in the Drone Market?

NOTE: For a more updated view of the Drone Market, please see our December 2024 Post: Drones From Sky-High Hype to Grounded Reality

It would be nice if there were facts to inform our decisions. Right?

Fortunately, there is, and we will give it to you.

First, a note about the data: where it came from and why these facts are the best available about the drone market.

The FAA in the United States passed a rule on December 21, 2015 (https://www.faa.gov/news/updates/?newsId=84386) requiring that all drones (weighing over 0.55lb and less than 55 pounds) be registered before they are flown.

A court decision overturned that rule in 2017, and registrations lapsed until the National Defense Authorization Act passed in December 2017 reinstated those rules.

Today, the law requires all drone flyers to follow particular rules regarding how they operate their drones in flight.

The rules fall into three primary groupings: Hobbyist, Non-hobbyist (or Professional), and Non-hobbyist with special exemptions.

Hobbyists can fly under a particular rule established to support remote-controlled aircraft activities.

You remember the remote-controlled airplanes, don’t you?

This rule is called “The Special Rule for Model Aircraft”. Drone operators flying under the Model Aircraft rules require registration with the FAA, including their name and location.

These hobbyists do not have to identify the model aircraft they will operate or if they are flying multiple drones.

Therefore, the hobbyist registrant data is limited to the number of registrants who fly drones by zip code, state, and country.

Yes, the FAA database encompasses registrants operating outside the USA.

Non-hobbyists, or Professionals, may fly under another particular set of rules that also govern where and when they can operate.

This series of rules is called “The Small UAS Rules (Part 107)”.

However, Small UAS rules can be restrictive.

For example, it limits flight to 400 feet, does not allow night flights, flights beyond the line of sight, or flights over crowds.

In instances where the drone operator wants to fly where it would violate the Part 107 rule, they must get an exemption from the FAA. This approval is called a Section 333 exemption.

For example, the news reporting channel CNN received one of the first Section 333 exemptions to fly over crowds of people.

Professionals must identify each drone model they are using and register their location for the FAA.

In June 2016, the FAA released its first database of registrants.

The FAA updated its data in October 2017 and released that database in November 2017.

Then, in January 2018, the DOT put out a press release with summary data on registrations.

The data released by the FAA gives us the most accurate information available about where hobbyists who fly are registered.

Yes, there may be unregistered drone owners, but these numbers are assumed to be small since registering as a hobbyist is free, and the fines can be hefty for violating the law.

And, yes, a hobbyist might fly more than one drone, but again, we estimate this to be a low occurrence since drone flying is a hobby that can be enjoyed one drone per operator at a time.

The data also gives us the most accurate insight into the manufacturers and models used by professionals and where they were registered.

For safety data, that is the incidences of near misses, the FAA receives and records reports of sightings near airports or commercial aircraft, which are assembled and made available in a quarterly release.

The data we are using from the FAA includes a very small number of international drones.

We cannot find another agency with similar public disclosure of drone data anywhere else.

And, few of the companies involved provide any data about sales.

So, we cannot get a complete fact-based picture of the global drone market.

Because we are vested in the industry, we are interested in what is happening.

Eager to get any statistics, we reviewed many drone market estimates and forecasts.

We found most of them based on a questionable analytic fact base.

So, while the FAA data does not cover the international picture, we still believe it most represents what’s happening in the drone market.

The USA drone market is believed to be the most significant and dominant drone market currently.

We present what we believe to be the most accurate data about what’s happening in the drone market based on the FAA data.

So, what does the data tell us?

So, what does the data on the drone market tell us?

How big is the Drone Market?

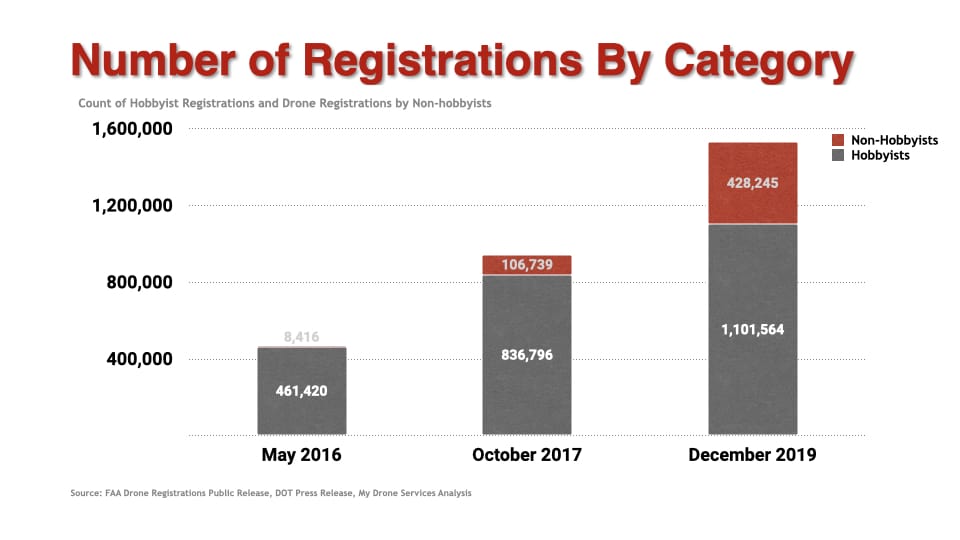

As of December 2019, there were over 1.5 Million total registrations of drones in the USA.

What has been the historic growth in drones?

As of May 12, 2016, the FAA showed Hobbyist registrations at 461,420 and commercial, public, and other drones (professional) at 8,416.

By October 31, 2017, the numbers had risen to 836,796 hobbyists (823,036 of whom were in the USA) and 106,739 professional models (105,738 of whom were in the USA).

On January 10, 2018, the FAA announced that over one million drones were registered in the USA.

The 1,000,000 total registration figure includes 878,000 hobbyists, who receive one identification number for all the drones they own, and 122,000 commercial, public, and other drones, which are individually registered.

When did the Drone Market first cross 1 million units sold?

On January 10, 2018, the FAA announced over 1 Million total registrations of drones in the USA.

The tremendous growth in drone registration reflects the fact that they are more than tools for commerce and trade, but can save lives, detect hazardous situations and assist with disaster recovery.

Elaine L. Chao, U.S. Secretary of Transportation

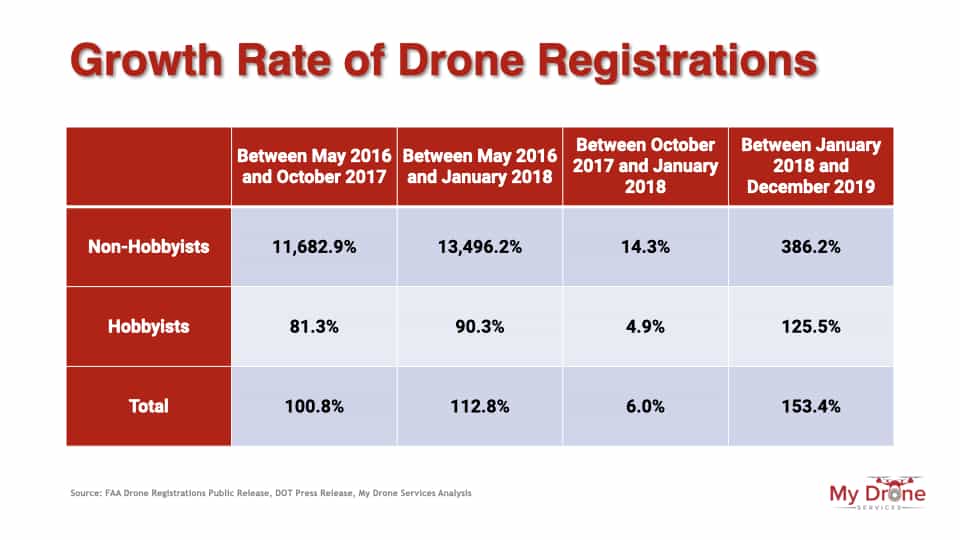

The market growth rates for each respective category of drones registered have been as follows:

Key Takeaways on Drone Market Size:

Hobbyist drone registrations had a dramatic early growth of 81% between May 2016 and October 2017.

But the 4.9% growth over the 2017 holiday season represents a tepid expansion.

As with all expensive personal consumer product categories, consumer drones appear to have a tendency to start fast and slow rapidly.

Professional drone registration growth has been scorching. However, that is from a low base of only 8,416 drones in 2016.

The market dynamics are still strong in the professional segment. The 14.3% market growth for the two months from October to date would still represent a hot compound annual growth rate of 80%+ and reflect increased demand.

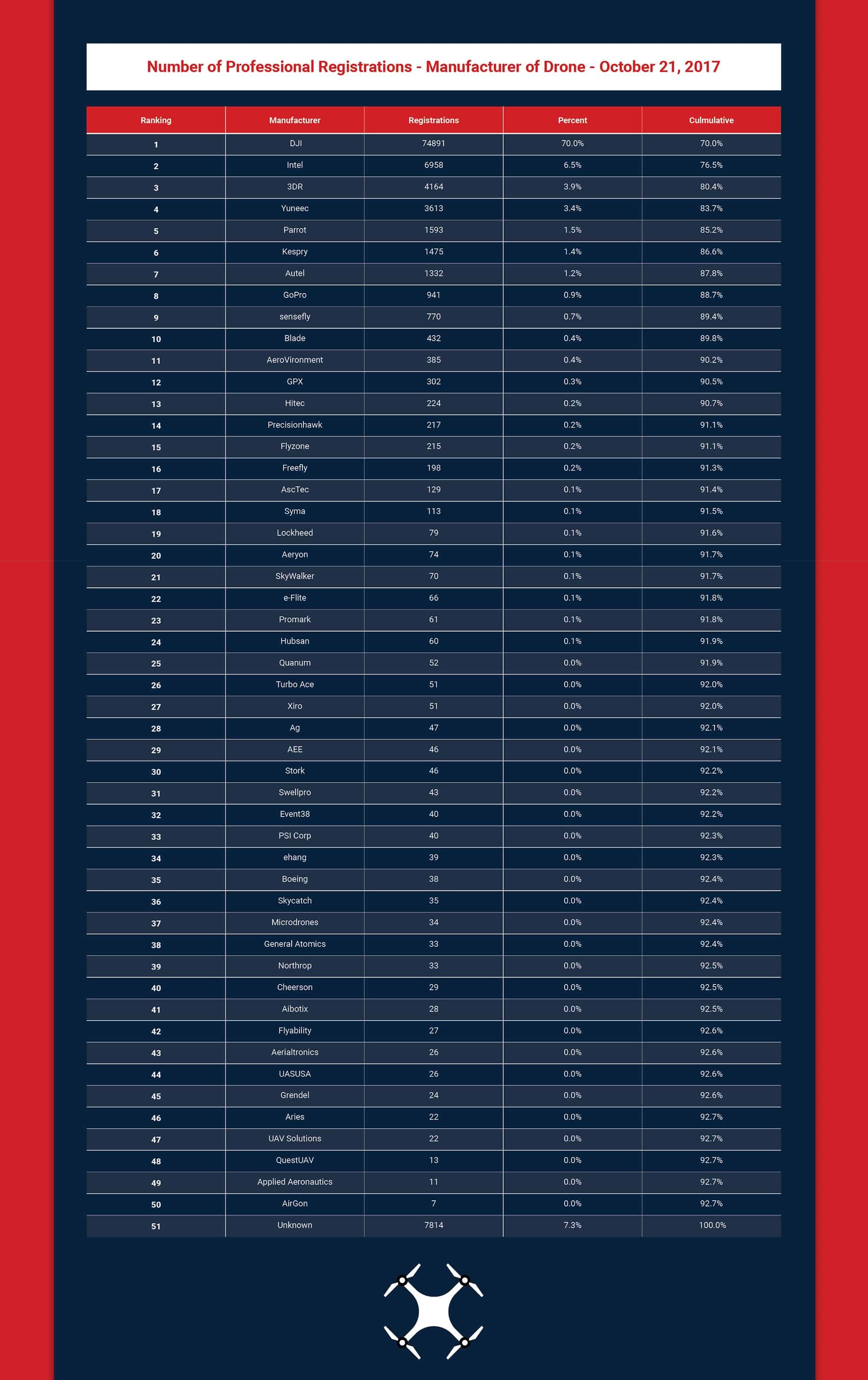

Which drone manufacturers are most successful in selling drones in the current drone market?

Key takeaways on Drone Manufacturers:

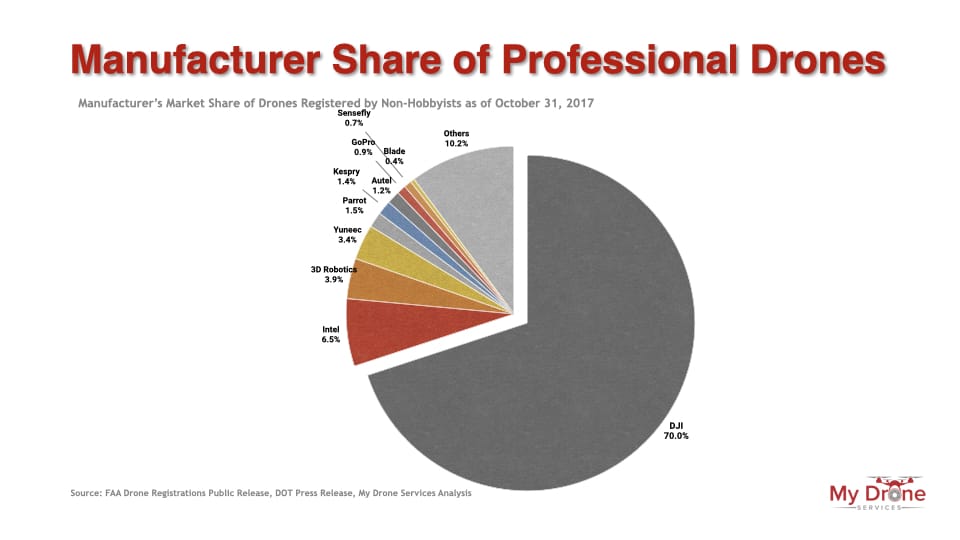

As of October 2017, over 50 manufacturers have had their drone models registered by professionals.

DJI was, by far, the overwhelming market leader. They manufactured over 70% of the units that professional drone flyers registered with the FAA.

Remember, the Hobbyists were not required to register the manufacturer model of the drones they were flying, so we don’t know the exact manufacturers of hobbyist drones. However, anecdotal evidence suggests DJI is also the undisputed leader in hobbyist drones, where many retailers indicate DJI is dominant.

Intel has been a latecomer to this party but is already number 2, passing up long-time competitor 3D Robotics at number 3.

Yuneec and Parrot were early entrants, and they rounded out the top 5.

The rankings here are only based on units.

Several industry players prefer to sell fewer but significantly more expensive drones.

Thus, if we redo these rankings based on revenue, we expect several manufacturers to rank lower on our current list to move up much higher.

Companies like Lockheed Martin produce niche drones with significantly higher selling prices than DJI and the other top five.

While analysts have attempted to estimate revenues, actual sales revenue is unavailable in any fact-based database.

Regardless of the limitations in available data, DJI is the undisputed market leader in consumer drones used by hobbyists and professionals.

How many drone hobbyists and drone professionals are flying today?

As of January 10, 2018, the Department of Transportation (FAA) reports that 878,000 hobbyists registered as drone pilots.

We estimate the number of professional drone flyers to be 100,000. But it is an estimate! The FAA only made public the number of professional drone registrations and not the number of licensed professional pilots.

One fact base we could use would be a count of the number of applicants who have taken and passed the FAA remote pilot certification test.

However, this data would only provide a partial picture of the number of professional drone flyers.

That is because the rules allowing commercial drone flights allow certified pilots or someone under their supervision to command the drone.

We know several professional drone services firms that have multiple drones.

They also have multiple pilots, some of whom may have registered as a hobbyist for their drones, some of whom are certified, and others flying under certified supervision.

These various possibilities make it difficult to pinpoint the exact number of professional drone pilots.

Based on our discussions with drone service companies and other market experts, our best estimate is that the number of professional drone flyers in the USA is nearing 100,000.

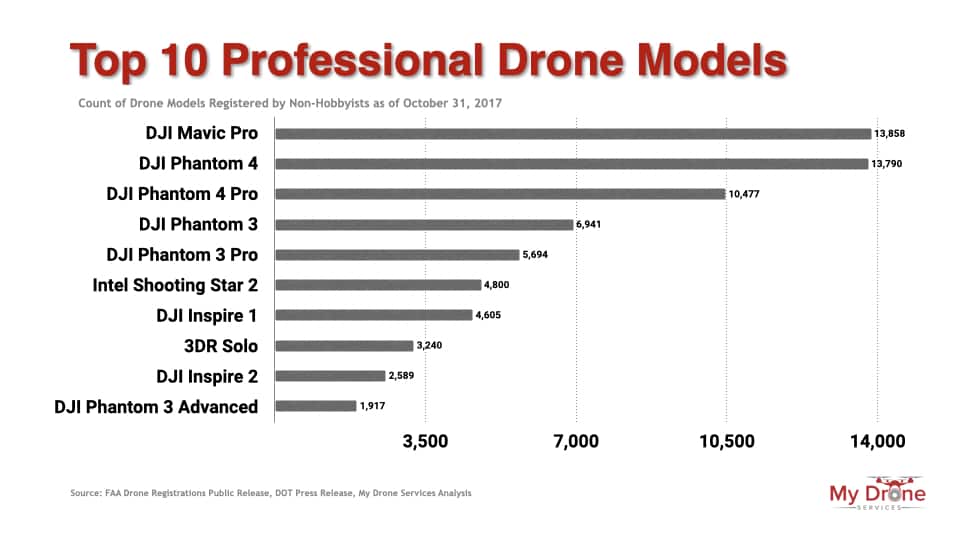

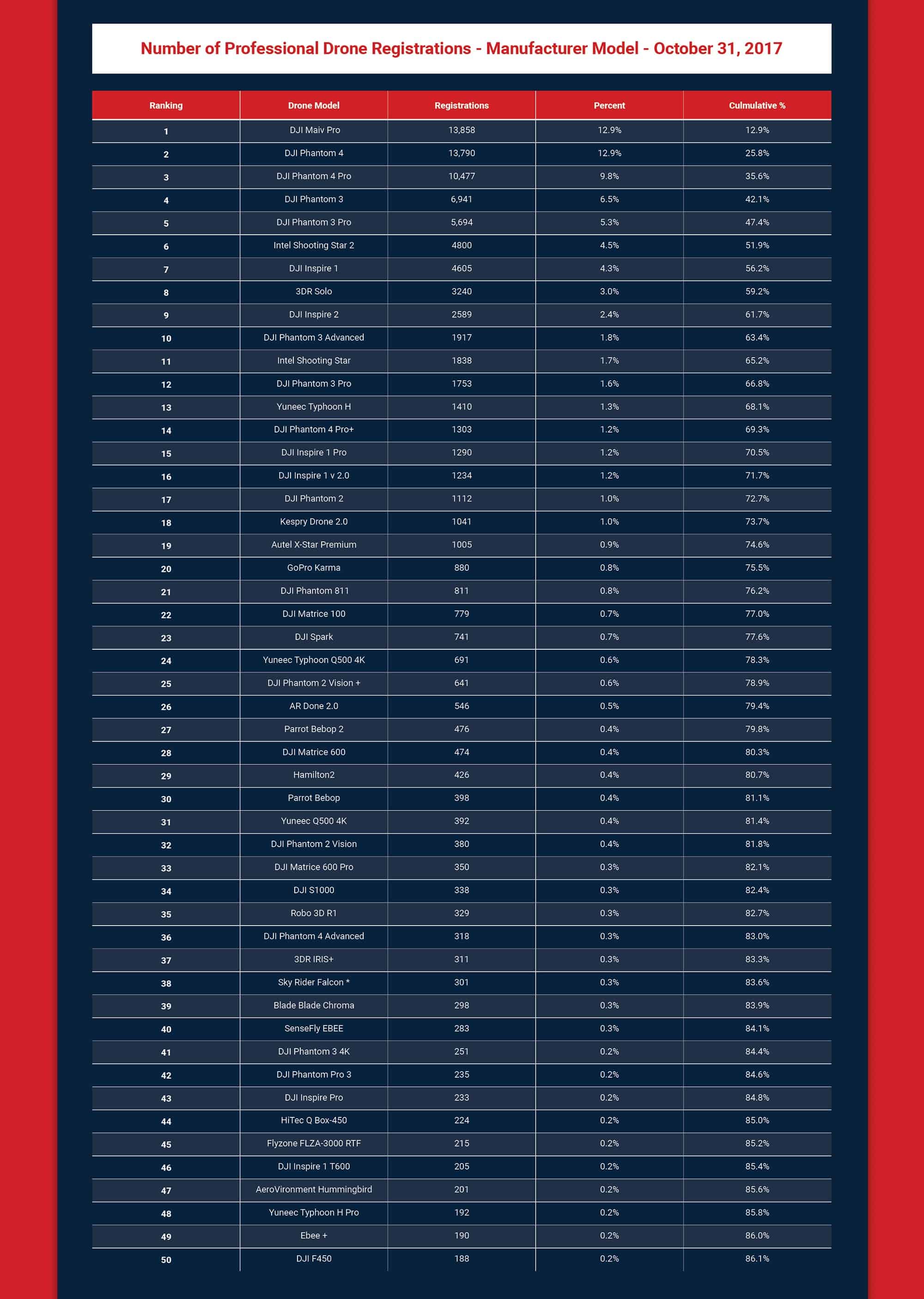

What are the drone professionals flying?

The vast majority of professionals are flying DJI drones.

As mentioned before, DJI manufactured over 70% of the professional drones registered, including 8 of the top 10 drone models.

For more details of drones registered for flight by professionals, see below the list of the top 10 models registered with the FAA as of October 31, 2017.

Key Takeaways on Drone Models Used by Professionals:

The DJI Mavic is the most used professional drone model.

DJI sold the Mavic by highlighting its versatility and reasonable price point.

The Mavic can produce good images and video, the most mature applications for drones used by professionals.

However, the Phantom series would be most dominant when looking at Drone families rather than individual models (even more than the Mavic).

The Phantom family has individual models occupying 5 top 10 spots in the model ranking.

The DJI Phantom 4 and Phantom 3 are dominant models professionals use, along with their Pro versions.

The only non-DJI models in the top ten are the Intel Shooting Star 2 and the 3D Robotics Solo, which are ranked 6 and 8, respectively.

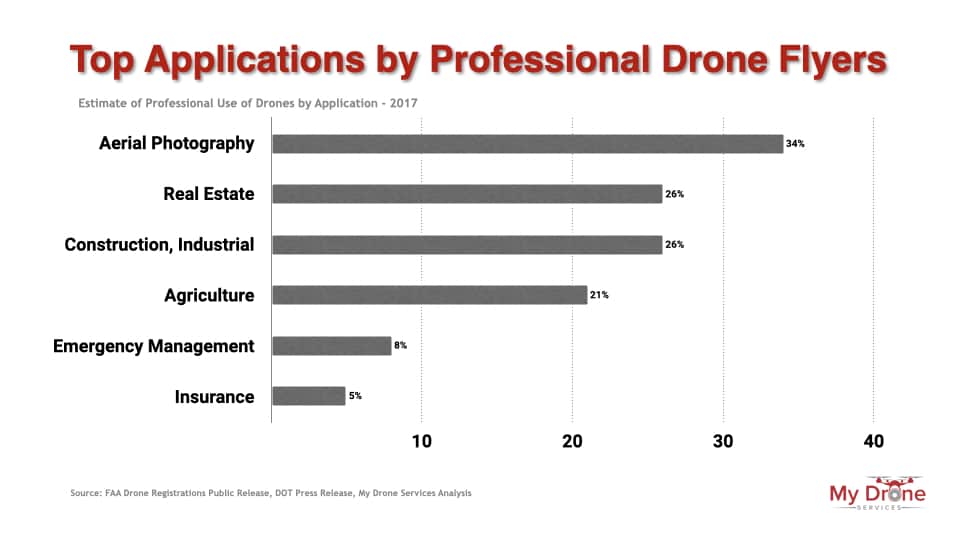

What are the most Popular Applications for Commercial or Professional Drones?

Key Takeaways on Commercial Drone Applications:

The original strength of drone technology was its ability to collect imagery and videography.

As expected, photography and videography are the most mature and highest-penetrated commercial drone applications.

Thus, aerial photography, real estate, construction, surveillance, monitoring applications used by law enforcement, and industrial photography and videography are the applications commercial operators report being involved in the most.

Newer applications for drone use in oil, gas, energy, utility, public safety, law enforcement surveillance applications, and transport drone inspections are just emerging.

So, too, agriculture spraying or even drone deliveries are still in the early stages of adoption.

As of early 2017, those new drone applications had such limited use they did not even register during surveys of commercial drone operators.

We expect significant growth in these new drone applications in the coming quarters.

How many drones are there in each state?

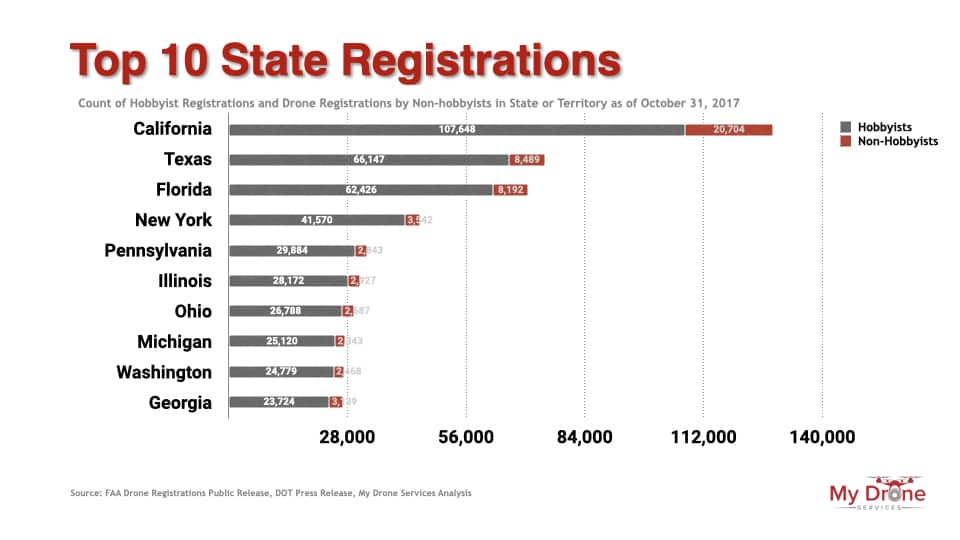

Key Takeaways on Drone Registrations by State:

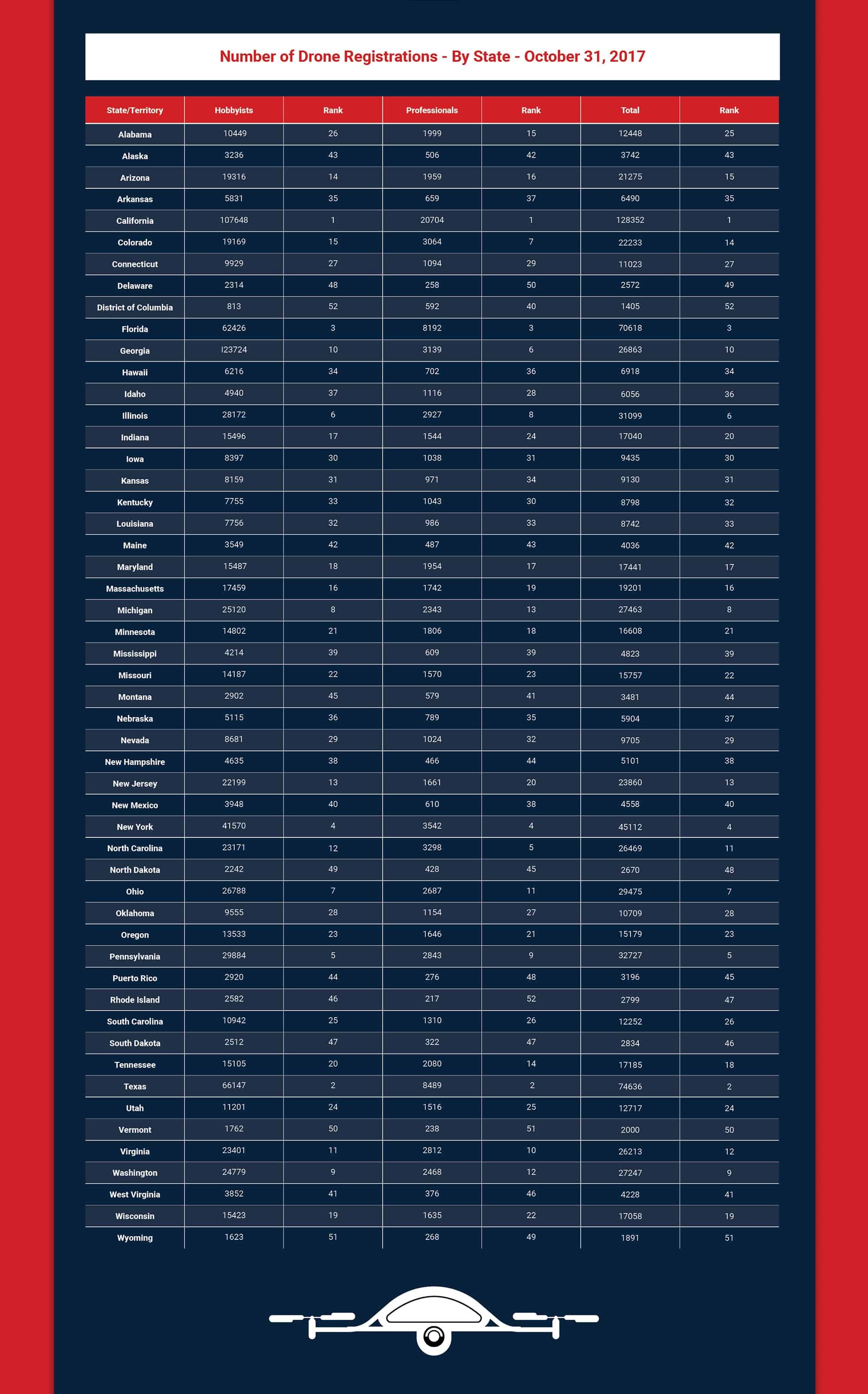

California represents almost 14% of the total drone registrations, with over 124 thousand registrations.

California leads the number 2 ranked Texas by over 50 thousand.

With Over 100 thousand Hobbyists and over 20 thousand Professionals, California is the leader by every count.

Rounding out the list of top 5 states are Texas, Florida, New York, and Pennsylvania at number 5.

We should note that although Pennsylvania gets the number 5 rank overall, that ranking was due to its hobbyists.

On the professional side, North Carolina is ranked number 5, while Pennsylvania is much lower at number 9.

The states or territories with the lowest drone registrations are North Dakota, Delaware, Vermont, Wyoming, and the District of Columbia at the bottom of the list.

Which states have a high penetration of drones? Low penetration?

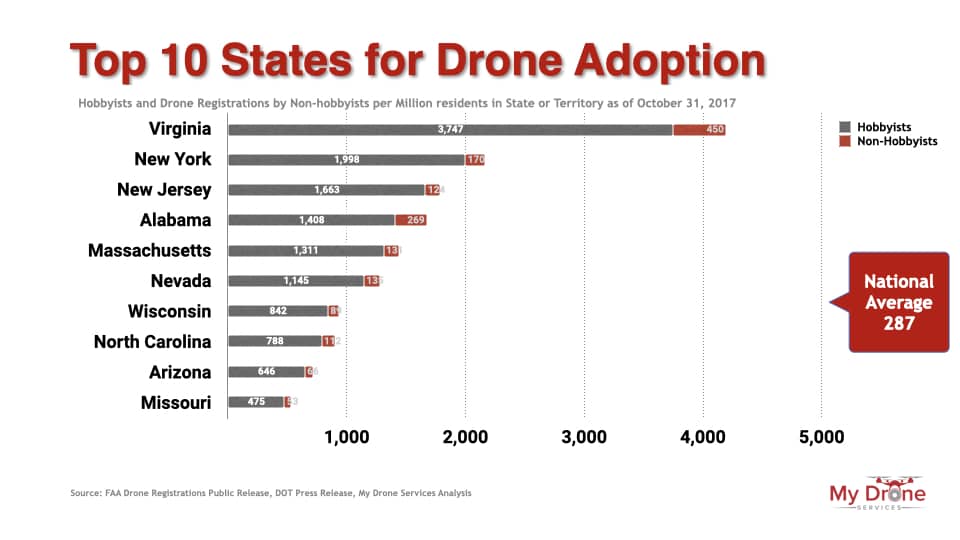

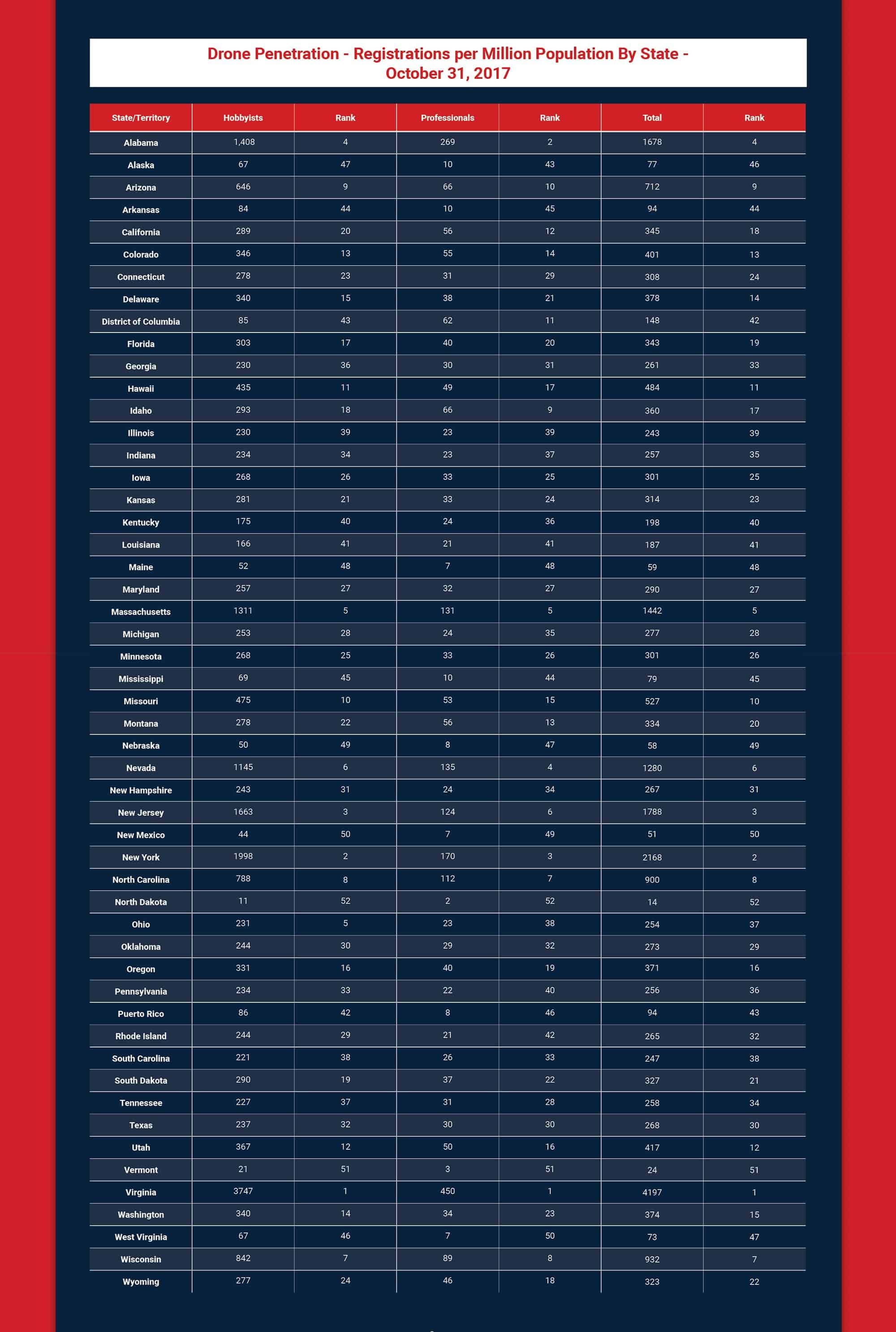

Key Takeaways on Drone Penetration by State:

In the United States, there are 287 drone registrations for every one million residents. This total comprises 254 hobbyists and 33 professionals.

The drone penetration rate of ownership within the United States is low compared to ownership rates among other modern-day technologies such as cameras, televisions, or even automobiles.

Because the drone ownership penetration rate is so low, we expect that there is still a lot more room for the drone market to grow.

Virginia is the most penetrated state for Drone registrations.

It ranked number one in both Hobbyist and Professional registrations per million residents.

At approximately 4200 registrations per million, Virginia’s drone penetration rate is almost 14 times higher than the national average ownership rate.

The remaining states among the top 5 penetrated by drones are New York, New Jersey, Alabama, and Massachusetts.

These states are also ranked number 2 to 5 for hobbyist registrations.

They all show drone penetration rates many times higher than the nationwide average.

Professional registration rankings differed slightly from the total or hobbyists’ only rankings.

Professional drone penetration rankings showed Alabama at number 2, New York at number 3, Nevada at number 4, and Massachusetts at number 5.

New Jersey is ranked number 6 in professional penetration.

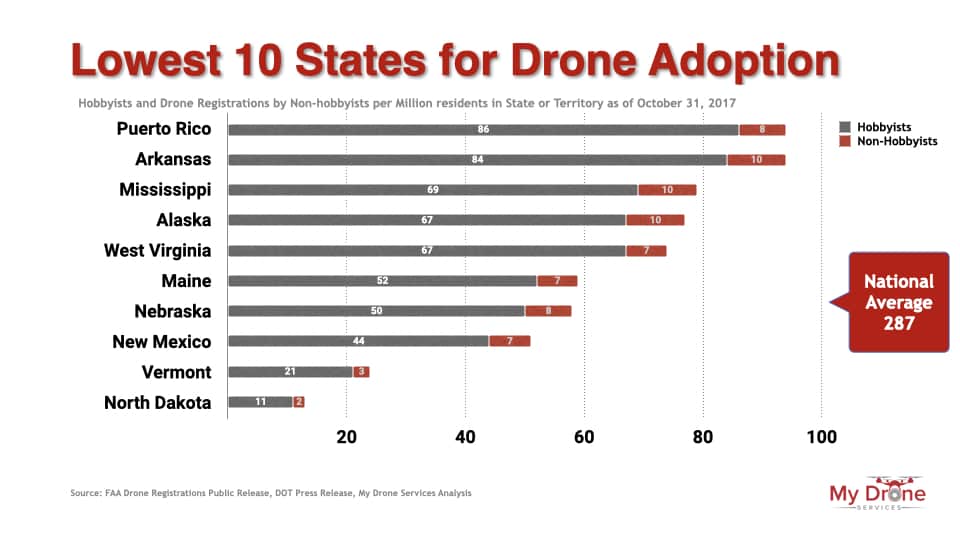

Maine, Nebraska, New Mexico, Vermont, and North Dakota are the five states with the lowest drone penetration rates.

Their penetration rate is over 80% below the nationwide average.

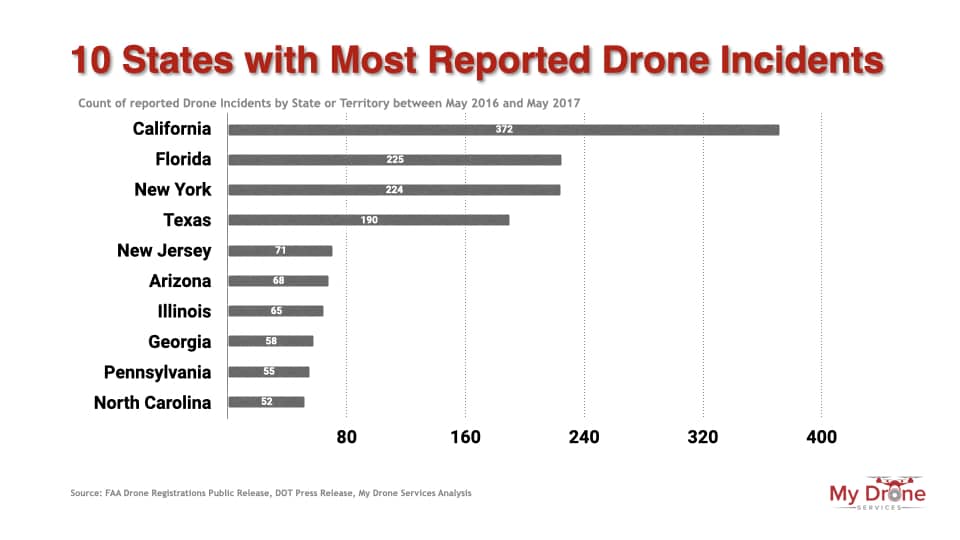

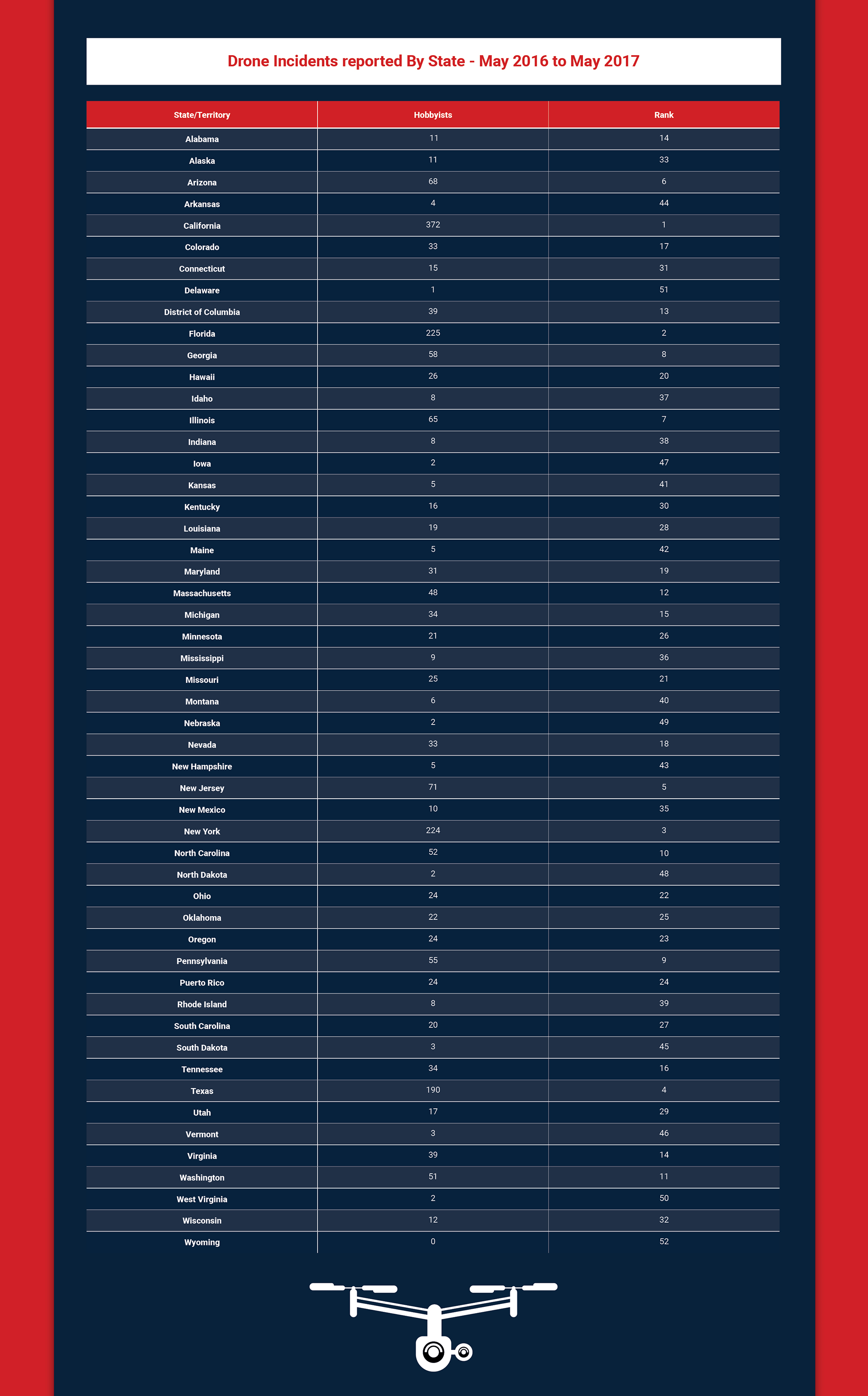

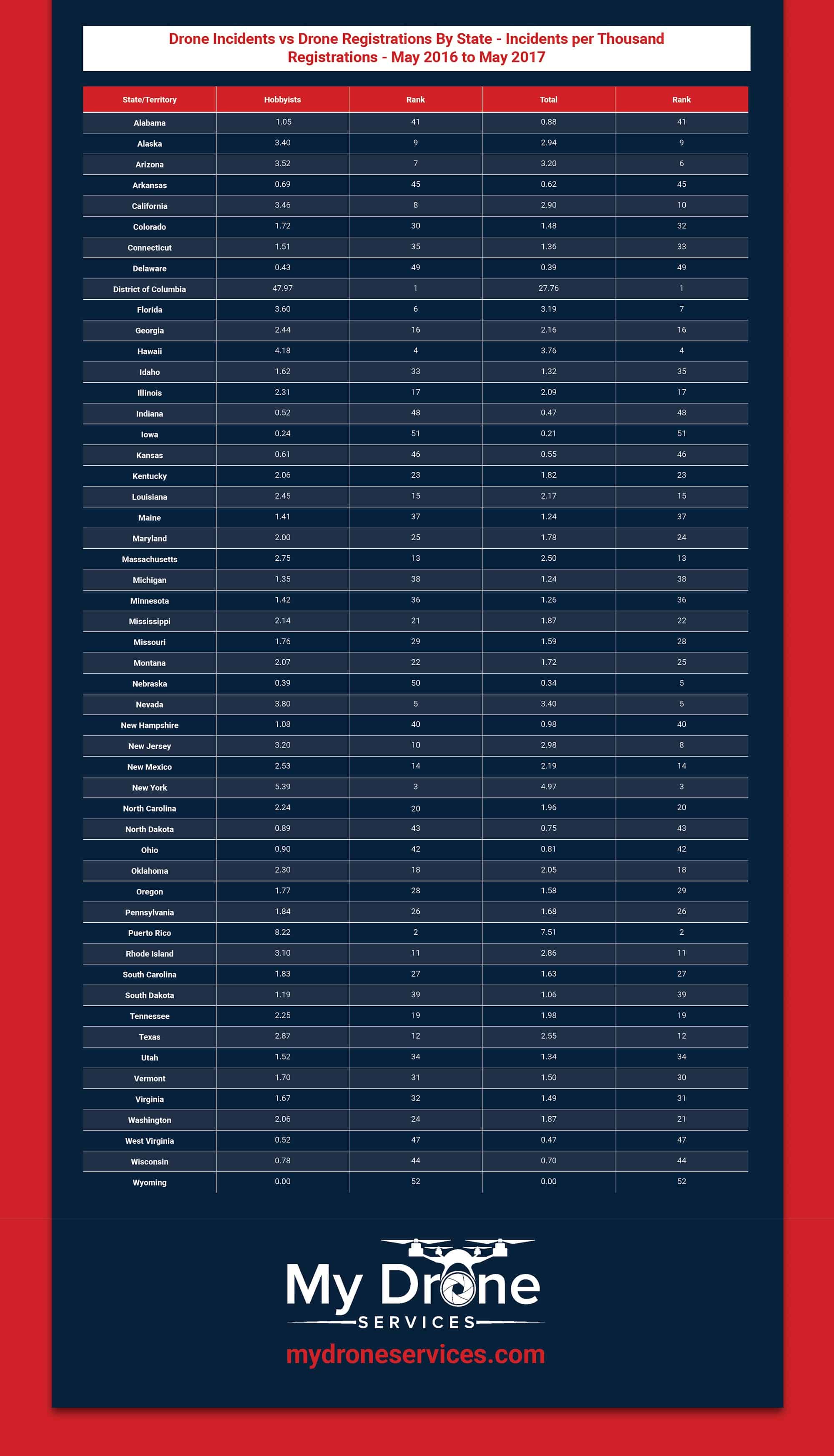

Which states have the highest and lowest drone incidents (near misses) reported?

From May 1, 2016, to May 9, 2017, the FAA recorded 2,092 incidents in which drones intruded into commercial airspace or were flown dangerously close to commercial aircraft.

Key Takeaways on Drone Incidents by State:

California is the leader in drone incidents reported, with almost 18% recorded.

The remaining members of the top five states with high drone incidents are Florida, New York, Texas, and New Jersey at number 5.

These top five states accounted for almost 52% of the drone incidents reported. California, Florida, New York, and Texas were all among the top five in drone registrations, suggesting a correlation between the number of registrations and incidents.

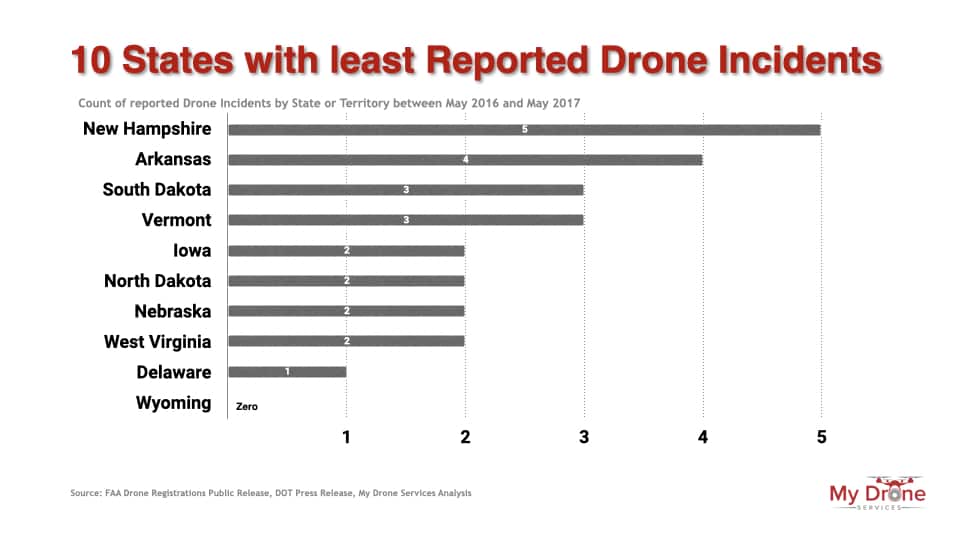

The five states with the lowest number of drone incidents reported were North Dakota, Nebraska, West Virginia, Delaware, and Wyoming.

Wyoming did not report any incidents. It was the only state with a flawless drone flying record during this period.

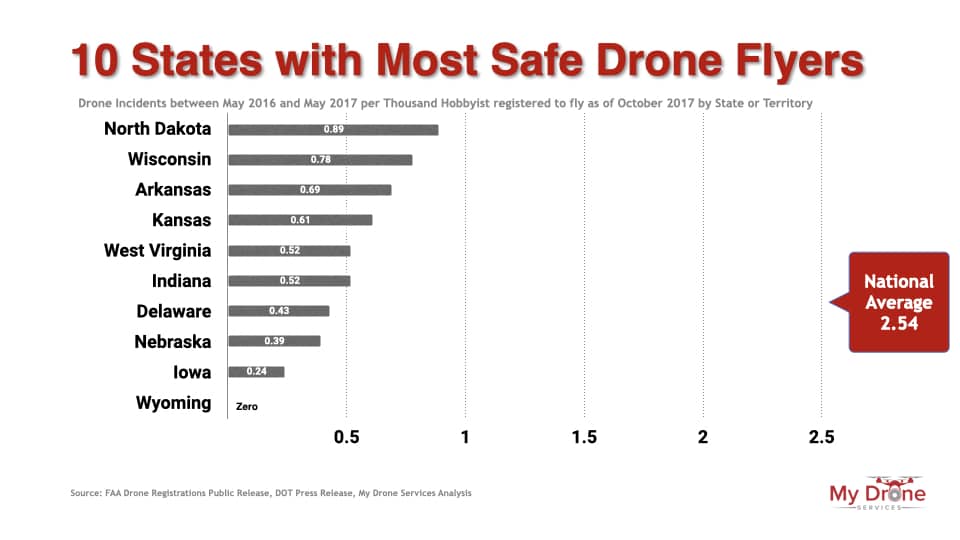

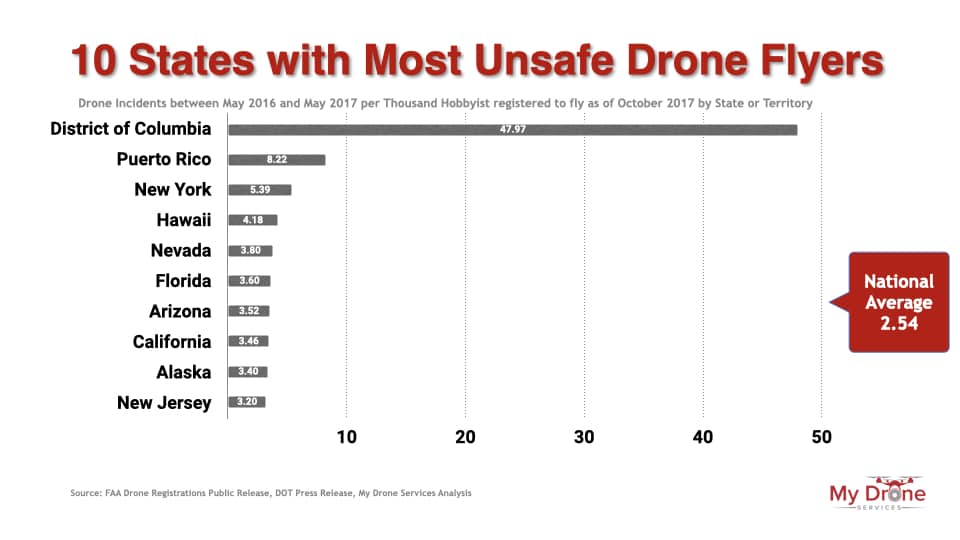

Which states have the safest/unsafest drone flyers?

In the US Territory, 2.25 incidents were reported for every thousand drone registrations.

That incident rate appears lower than the rate we think should be used.

That is because the rate was calculated, including all the professional registrations.

However, certified professional drone flyers are well versed in the rules and limitations of flying drones and are more vested in avoiding a commercial aviation incident.

Thus, we do not believe that professional drone flyers cause these reportable incidents. Instead, we think that hobbyists or unregistered flyers create most reported incidents.

We would use the incident ratio calculated using hobbyist registrations only. The drone incident rate when using hobbyist registrants only is higher, at 2.54 incidents per thousand registrants.

This is the most appropriate measure given that the professionals are certified, well-versed in the rules and limitations, and are significantly more vested in avoiding a commercial aviation incident. There is too much at stake for professionals.

Key takeaways on state-level drone safety:

The safest drone flyers are in Wyoming, with no incidents reported during the period.

The second safest was Iowa, where the incident rates were 90% lower than the nationwide average.

Nebraska, Delaware, and Indiana came in third, fourth, and fifth, all showing incident rates dramatically lower (at least 80% ) than the average nationwide.

The least safe state/territory for drone incidents is the District of Columbia.

DC had a whopping 47 incidents reported per thousand hobbyist drone registrants.

This number is almost 25 times higher than the nationwide average.

No other state or territory showed such an outrageously high number of incidents involving people registered to fly drones.

Puerto Rico, New York, Hawaii, and Nevada are in the top 5.

All the top five showed elevated levels of incidents compared to the nationwide average.

We urge all drone flyers to operate safely.

The consequences of unsafe flying can be catastrophic!

We hope that, using the best facts available today, we have been able to shed some light on what’s happening in the drone marketplace.

We invite you to check out our other reviews of the drone market, where we combine our collective experience with the best minds to shed some light on what is really happening.

Some Drone Market Estimates and Market Forecasts:

Quite frankly, we have mixed views about the state of market intelligence. We wonder about the quality of the underlying research methodology.

Here is a collection of historical and current forecasts of the Drone Market size and projections for growth.

We leave it to you, the reader, to decide whether the historical forecasts were accurate and whether you believe the current forecasts.

Fortune Business Insights – 2018 research report

The Commercial Drone Market size is projected to reach USD 6.30 billion by 2026, at a CAGR of 23.37% during the forecast period. However, it stood at USD 1.20 billion in 2018.

Drone Industry Insights – Drone Market Forecasts

Drone Industry Insights projects the global market for drone technologies will reach $43.1 billion by 2024, up from $14.1 billion in 2018.

https://www.droneii.com/drone-investment-trends-update

From generating 22.5 billion USD in 2020, it will grow at a CAGR (Compound Annual Growth Rate) of 13.8% to almost double that in 2025.

https://www.droneii.com/the-drone-market-size-2020-2025-5-key-takeaways

IDC – Drone Market Forecasts and Research Reports

IDC predicts that the U.S. market for robotic/drone hardware will reach $9.2 billion in 2019, yielding a year-over-year growth rate of 15.6%. Robotics OT (operational technology) services will reach $3.4 billion in 2019, a year-over-year increase of 13%. For robotics/drone hardware, the U.S. represents about 14% of the global market.

https://www.idc.com/getdoc.jsp?containerId=IDC_P37304

Business Insider – Drone Market Estimates

Business Insider Intelligence predicts total global shipments to reach 2.4 million in 2023 – increasing at a 66.8% compound annual growth rate (CAGR). Drone growth will occur across the four main segments of the enterprise industry: Agriculture, construction and mining, insurance, and media and telecommunications.

https://www.businessinsider.com/drone-industry-analysis-market-trends-growth-forecasts

Grand View Research Report

The global commercial drone market size was valued at USD 5.80 billion, with an estimated 274.6 thousand units sold in 2018. The market is anticipated to register a CAGR of 56.5% during the forecast period. These Unmanned Aerial Vehicles (UAVs) are finding increasing application across the entertainment, agriculture, and energy sectors, which is ultimately expected to impact the market growth positively.

https://www.grandviewresearch.com/industry-analysis/global-commercial-drones-market

Business Research Company 2020 Drone Market Report

The global commercial drones market was valued at about $3.45 billion in 2018 and is expected to grow to $7.13 billion at a CAGR of 19.9% through 2022. Commercial drones are being considered by companies that have last-mile delivery as their main business operation. The drones will help reduce cost per delivery and delivery time, thus increasing profits, which will in turn increase the growth of the commercial drones’ market.

Goldman Sachs 2016 Research Analysis and Drone Market Research Report

Between now and 2020, we forecast a $100 billion market opportunity for drones—helped by growing demand from the commercial and civil government sectors.

Drones got their start as safer, cheaper and often more capable alternatives to manned military aircraft. Defense will remain the largest market for the foreseeable future as global competition heats up and technology continues to improve. Military Drones are a $70B market.

The consumer drone market was the first to develop outside the military. Demand has taken off in the last two years, and hobbyist drones have become a familiar sight, but there is plenty of room for growth. Consumer Drone Market is estimated at $17B.

The fastest growth opportunity comes from businesses and civil governments. They’re just beginning to explore the possibilities, but we expect they’ll spend $13 billion on drones between now and 2020, putting thousands in the sky. Here’s where you might see them. Commercial Drones represent a $13B market.

https://www.goldmansachs.com/insights/technology-driving-innovation/drones/

Our Take on the state and future of the drone market

We will publish a separate, more timely piece addressing our views on the state of the drone market, but for now, let’s see if we can boil it down.

The Pundits have been incredibly wrong in hyping the size and growth of the drone market.

The value chain has been under tremendous pressure, as many of the major leaders just a few years ago continued to struggle or left the market.

DJI reportedly loses money despite the largest market share estimated at 70%, at least among amateurs.

Intel, the much-ballyhooed entrant with some interesting industrial offerings allowing a high degree of customization of the underlying drone technology, has exited the business.

Forecasts by market segment have been overly optimistic by any measure. The overall market has stalled. And the market drivers have been sputtering. Service providers are losing money.

Survival for many is not guaranteed.

Are there growth opportunities? Yes.

There are segments with increasing demand. However, the growth opportunities vary dramatically by market segment and will require some time to develop.

Are you focused on the consumer market? Expect continued pressure!

Where is the rising demand? Where do we expect to see growing and high demand?

Although the drone services market is relatively small currently, we certainly see opportunities for future high demand in the commercial sector.

For service providers and professionals, where the market will most likely grow fastest, we will need to see a whole new product portfolio from drone providers. We want to see more drone technology tuned to one or more specific use cases and commercial applications. Expect to see an interesting strategic partnership among service providers and a redesign of the supply chain based on careful value chain analysis.

We hope to see you on the other side.

Sources:

FAA G=Fact Sheet https://www.faa.gov/news/fact_sheets/news_story.cfm?newsId=21514

UAS Sightings https://www.faa.gov/uas/resources/uas_sightings_report/

May 2016 Registrations http://www.faa.gov/foia/electronic_reading_room/media/Reg-by-City-State-Zip-12May2016.xlsx

FAA Forecast https://www.faa.gov/data_research/aviation/aerospace_forecasts/media/Unmanned_Aircraft_Systems.pdf

FAA Registration data

https://www.faa.gov/foia/electronic_reading_room/media/sUAS_Hobbyist_Registration-2017-10-31.xlsx

Leon Shivamber

Partner

Advisor, Entrepreneur, Strategist, & Transformation Agent

Tom McKeefery

Partner

Transformation, Technology, Supply Chains, and Operations